- Interval funds have increased in popularity in recent times

- As private markets become more accessible, new investors may sometimes require their capital back earlier than the traditional institutional players

- Interval funds offer investors the option to repurchase shares at set periods and at net asset value (NAV) throughout the calendar year, instead of having to go through a secondary sales process

- These funds offer earlier redemption opportunities at set intervals for investors while investing in more illiquid areas of private markets for potentially greater returns

As we have highlighted throughout our introductory private market articles, the world of private market investing has become increasingly accessible to a wider pool of investors which have, in turn, benefited from the possible benefits and returns on offer.

However, as new entrants begin to consider private markets, fund managers must be nimble and adapt accordingly, offering solutions to cater to the specific needs of high-net-worth-individuals (HNWIs) and sophisticated investors. After all, contrary to institutional investors who can take long-term views to match long-term liabilities, a lot can happen in an individual’s life over the typical fund term of 10 years that may require access to capital sooner than expected. Whilst individual investors do typically understand the long-term nature of private market investments and the resulting illiquidity, other exit options typically include a secondary sale, which may be less efficient.

A secondary sale refers to the process of the selling of a primary (i.e., original) stake in a fund, including remaining commitments, to a counterparty, such as another individual or a fund specialised in purchasing secondary assets. The process is typically privately negotiated, with pricing dependent on both asset quality and supply-demand dynamics, and with prices quoted in terms of percentage of net asset value (NAV). The secondary sale process can take several months, and recovery of NAV is not always guaranteed (portfolios can sell below NAV).

Not a typical closed-end fund

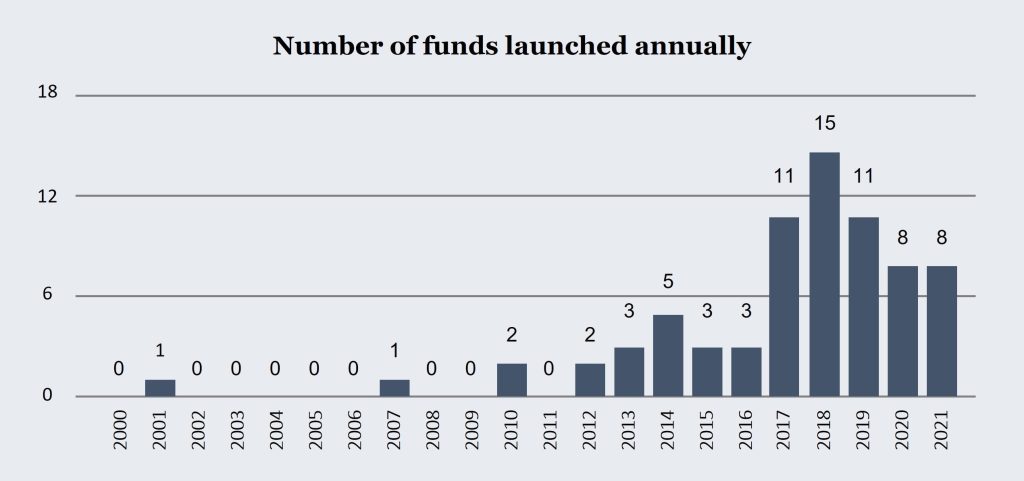

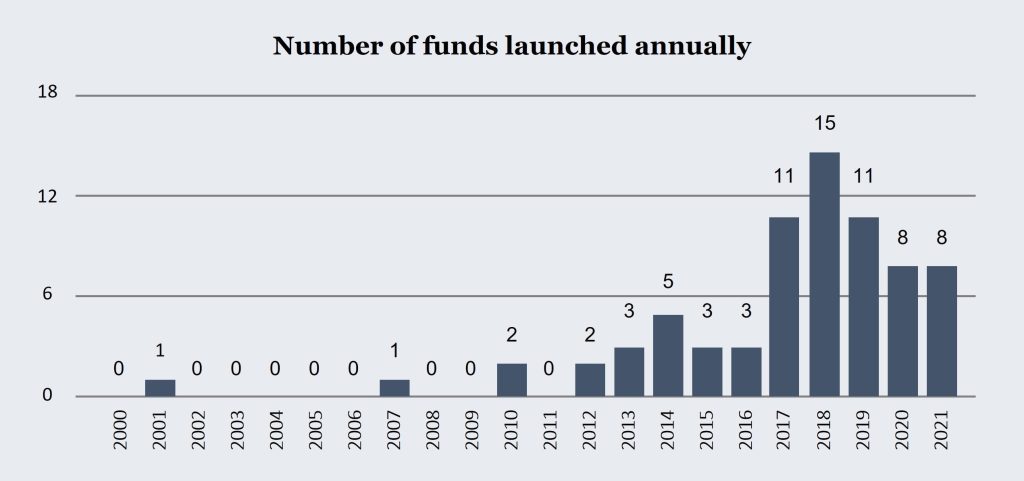

As we can see from figure 1 below, new launches of interval funds have increased greatly over the last few years, but why are we seeing this phenomenon and what are the benefits for investors considering this investment vehicle?

Figure 1: Increasing popularity of interval funds1

Source: CEFData

Before we look into this trend in greater detail, it’s worth highlighting what an interval fund actually is and the unique characteristics it holds in comparison to more traditional investment vehicles in the private market sector.

Strictly speaking, interval funds are closed-end funds and, as would typically be the case, are registered under the Investment Company Act of 1940 in the US, enjoying many of the same regulatory protections as other closed-end funds. However, in comparison to traditional public counterparts, interval funds do not typically undergo an initial public offering and are not usually traded on an exchange. Shares in the fund are continuously offered and issued on an ongoing basis, much like open-end mutual funds.

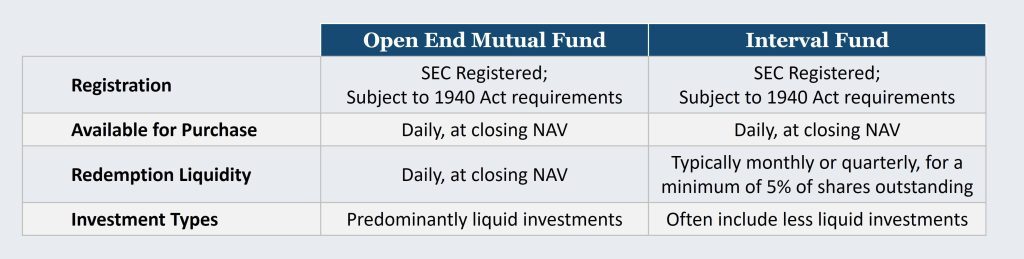

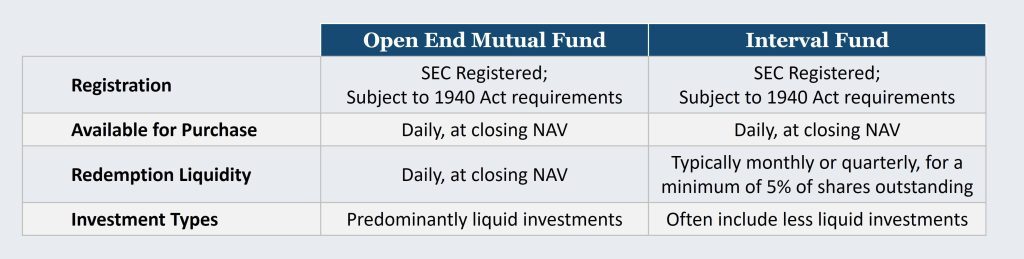

However, there are key areas of differentiation from mutual funds to consider.

- Liquidity – Interval funds do not provide investors with daily liquidity but instead offer investors the option to repurchase shares at set periods (usually quarterly) NAV throughout the calendar year.

- Illiquid Investments – As interval funds are not required to cover investor redemptions on a daily basis, there is no limit to the amount of illiquid investments the fund can make, unlike mutual funds which typically have a limit of 15%.

- Redemptions – Interval funds do not offer mandatory redemptions. The periodic withdrawal limits are set by the regulator to ensure that these vehicles remain predominantly private, and do not cross into the publicly listed/traded territory.

Figure 2: How do interval funds compare to mutual funds?2

Source: Lord Abbett

The good news for fund managers is that they can use this flexible structure in their favour. Due to not having to meet daily redemption requests, interval funds provide the managers with a source of stable capital which offers greater flexibility to invest in less liquid assets and commit to investment strategies with longer holding periods for potentially greater returns.

This predictable flow of capital into the fund also allows managers to take advantage of opportunistic opportunities in real-time, responding to ever-changing market dynamics.

How do investors access capital?

When fund managers have to meet the periodic redemption requests from investors, there are a number of avenues available to them such as the traditional route of offsetting inflows and outflows into the fund, utilising cash returns already generated by the portfolio investments, using a subscription credit facility or, presumably as a last resort, delving into the cash on their balance sheet.

Understanding interval funds offer the option to repurchase shares at set intervals and being aware of how fund managers fulfil these requests is key, but how do investors actually go about accessing their capital?

To take the 1940 Act mentioned as an example, each repurchase offer must legally consist of between 5% and 25% of a fund’s outstanding shares.3 While the set interval period for offering shares can vary between funds (but most tend to be quarterly), investors must be adequately notified by the fund manager when the repurchase period commences, including specific details on the deadlines and costs involved.

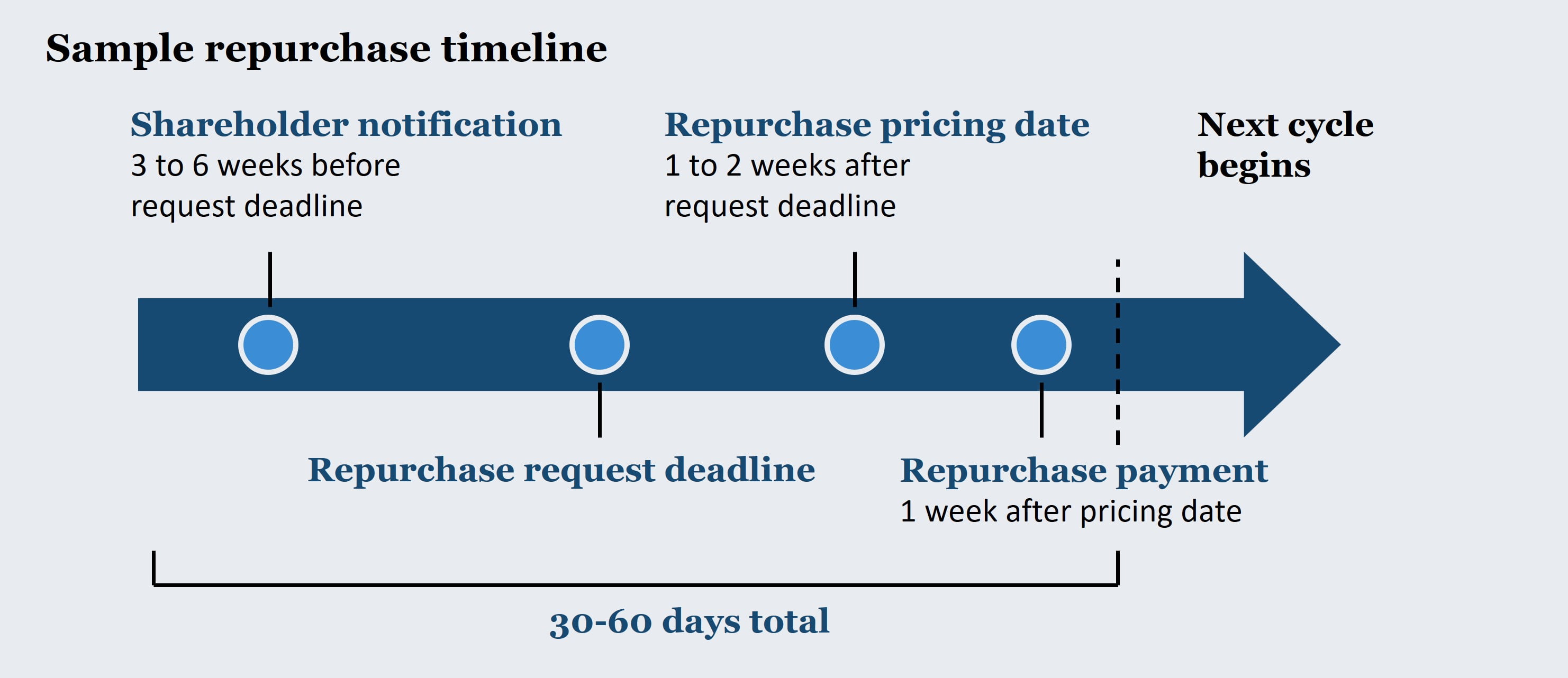

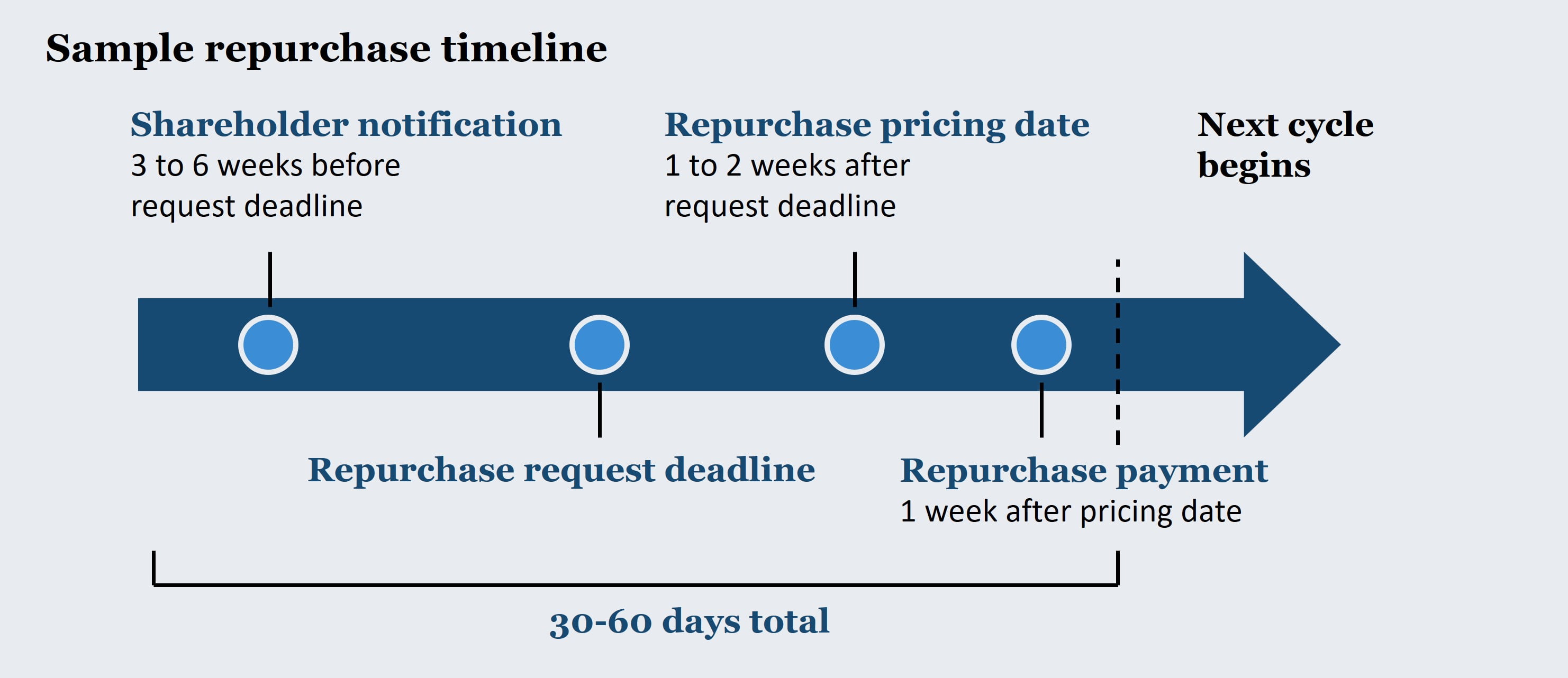

If investors wish to accept a repurchase offer, they must notify the fund by the offer deadline – this is non-negotiable. Figure 3 below shows an example of a repurchase process including the timeline from when an investor receives a ‘pricing date’ one-two weeks after the repurchase request deadline to subsequently receiving payment approximately one week after this date.

Figure 3: Sample repurchase timeline4

Source: BlackRock. For illustrative purposes only. Individual funds will each have their own distinct schedule associated with repurchase offers.

As interval funds do not provide daily liquidity, fund managers do not have to worry about providing daily capital in response to redemption requests. The fund managers will take advantage of this stable source of capital by putting it to work in more illiquid assets, such as private equity, debt and infrastructure which are often the most challenging for investors to buy, sell…and actually access!

The obvious benefit for the investors here is that these types of investments will often earn higher returns vs. liquid assets which is the trade-off for accepting less access to capital – often referred to as the “illiquidity premium.”

However, there is certainly more flexibility when comparing interval funds with more traditionally structured private equity funds. In our previous article “In pursuit of cash flow- considering contributions, fees, distributions and returns when investing in private market funds”, we discussed how typical private market funds should be viewed as largely illiquid due to their return profile following a so-called ‘J-Curve’ which is the tendency to post negative returns in the initial years followed by positive returns in later years when the investments mature and start returning cash.

In comparison, an interval fund allows a manager to create a seed portfolio, and as the fund grows, a fully deployed portfolio, effectively removes blind pool risk for investors. Furthermore, interval funds typically call capital upfront, meaning that both the J-curve, as well as the need to deal with future capital calls are both removed. This allows investors to create a fully deployed private markets allocation, periodically rebalanced by the fund manager, as opposed to having to put in place and execute a strategy of multi-year commitments.

These factors explain why it makes sense for some investors to balance their portfolios with exposure to an interval fund which, although still viewed as a more illiquid investment and long-term investment approach, does give them an opportunity to (periodically) exit to meet any liquidity requirements they may have.

Unlike traditional institutional LPs, HNWIs and sophisticated investors are more likely to seek earlier exits from their investments and may therefore consider interval funds which could offer both the long-term potential benefits of investing in hard-to-access areas of private markets and also the option of having a simplified and predictable exit process.

Proceed with caution

As ever, risks may vary according to the investment vehicle an investor chooses and interval funds are, like all investments in the private markets, not without an element of risk associated. Investors must understand the make-up of the fund and where the capital is being invested. For example, some funds offering greater liquidity opportunities may invest in more liquid assets, which in some cases may result in lower returns.

Also, investors should view interval funds as a long-term investment as they can only access a certain percentage of shares at designated times. In periods of normal market activity, investors may get 100% of their capital back in one quarter, if the fund-level redemption limits are not reached. However, there may be periods in time when fund-level gates are imposed either by the fund manager or simply by law, and in these instances, it may take several quarters to redeem the entirety of the investor’s capital. In short, unlimited and instantaneous redemptions are not guaranteed.

Conclusion

In conclusion, interval funds can be an excellent option for many types of investors. Their unique characteristics make the funds a very useful option for those HNWIs who can accept the risks and who want to invest in traditionally difficult-to-access areas of private markets and be exposed to the potentially higher returns in the long term, while being able to exit earlier than 10 years and, crucially, at NAV!

Sources:

- CAIA: Interval Funds are a Fast-Growing Alternative Investment Vehicle, April 2022

- Lord Abbett, Interval Funds Explained, October 2022

- US Securities and Exchange Commission, Investor Bulletin: Interval Funds, 2020

- BlackRock, An introduction to interval funds, 2022

Disclaimer: All Rights Reserved. No part of this publication may be reproduced, stored in a retrieval system or transmitted in any form by any means, electronic, mechanical, photocopying, recording or otherwise, without the prior permission of the publisher, Bite Asset Management. The facts of this article are believed to be correct at the time of publication but cannot be guaranteed. Please note that the findings, conclusions and recommendations that Bite Asset Management delivers are based on information gathered in good faith from both primary and secondary sources, whose accuracy we are not always in a position to guarantee. As such, Bite Asset Management, can accept no liability whatsoever for actions taken based on any information that may subsequently prove to be incorrect.

This document has been prepared purely for information purposes, and nothing in this report should be construed as an offer, or the solicitation of an offer, to buy or sell any security, product, service or investment.