- Record levels of inflation across the globe are obliging investors to evaluate their portfolios in an effort to hedge against the current inflationary environment

- Private equity continues to demonstrate its flexibility by selecting suitable investments to thrive during periods of high inflation

- Private credit, real estate and infrastructure all continue to display favourable characteristics when hedging against inflation, furthering the arguments to include the asset classes as part of balanced investment portfolios

In the second article of our current series aimed at introducing readers to the world of investing in private markets, we wanted to discuss an urgent topic on the top of most investors’ agendas, rising inflation.

With global inflation on the up and showing no signs of abating, this article will detail how we believe the private markets will be impacted and the potential roles these asset classes can play in helping investors navigate the inflationary climate over the course of 2022 and beyond.

Record levels of global inflation

Due to the economic turmoil resulting from Covid-19, inflation across the globe has been steadily increasing for the last two years.

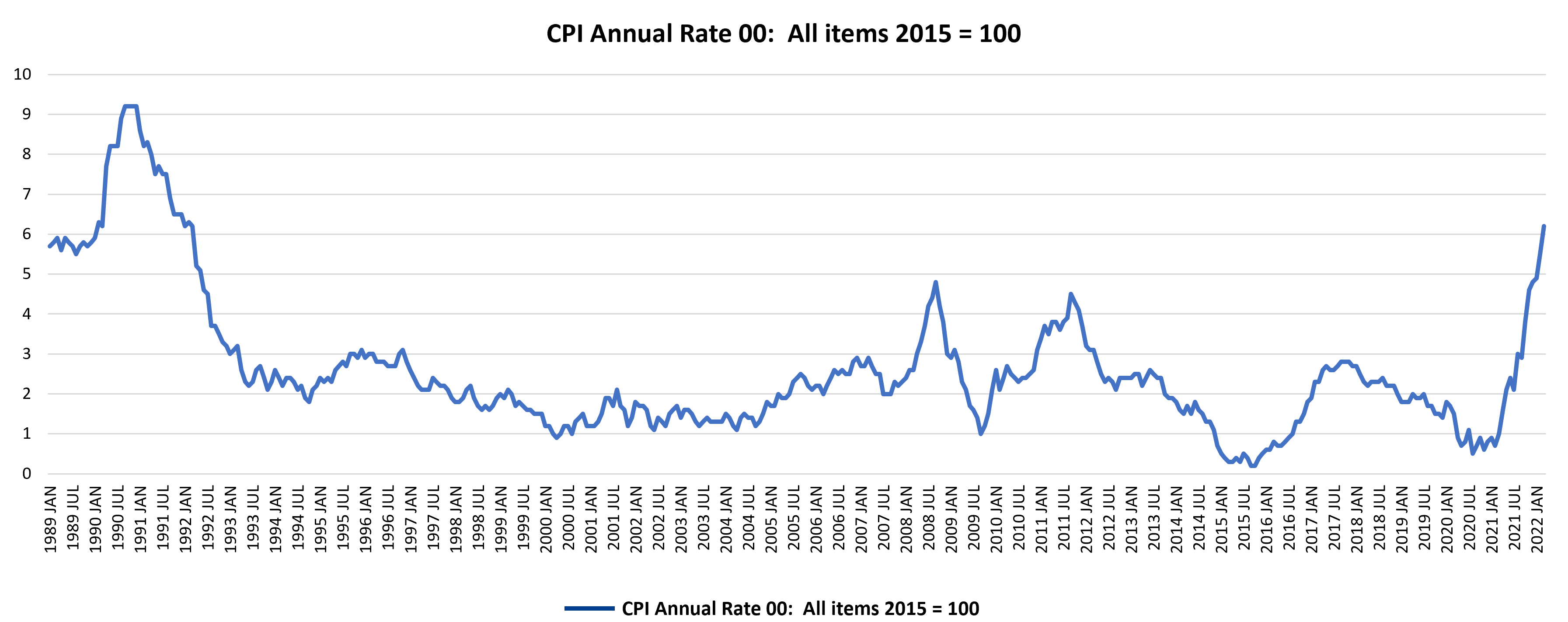

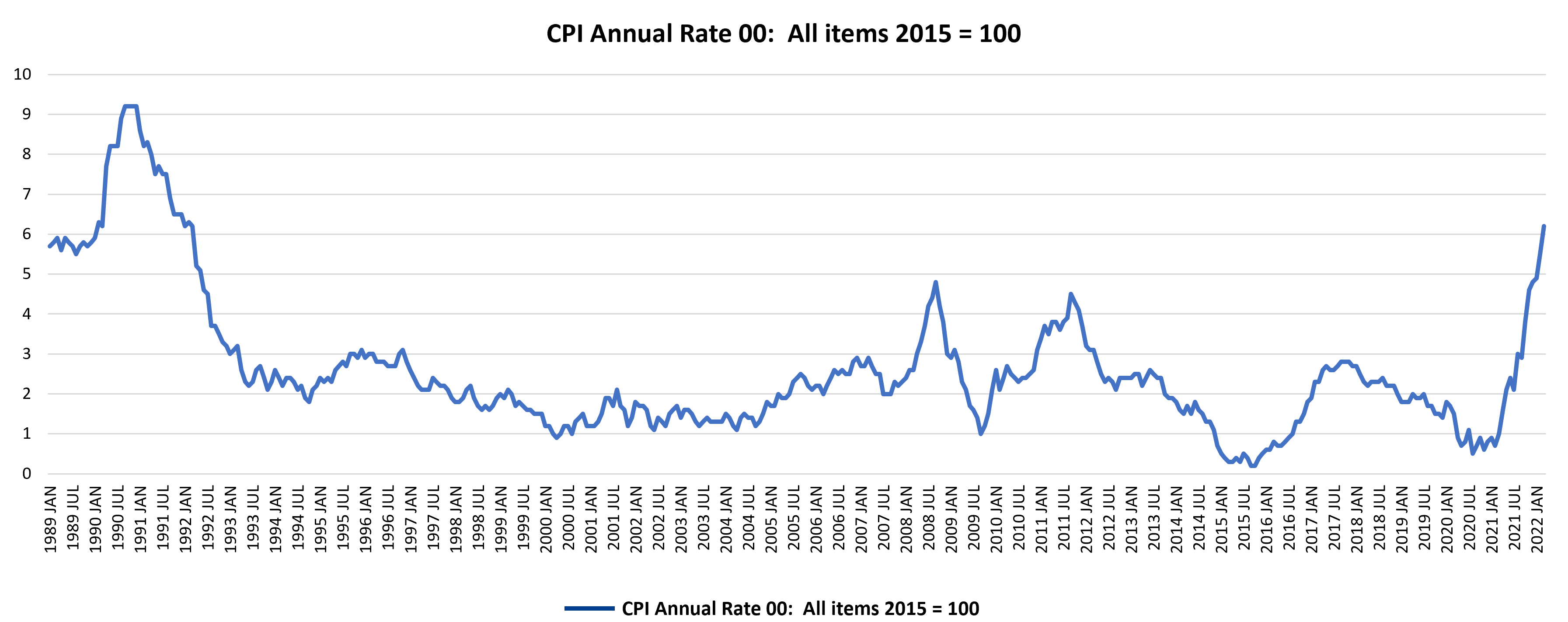

Figure 1: UK Consumer Price Index in February 2022 reached record high for 30 years1

Source: Office for National Statistics

Figure 1 shows us that in the UK alone, the Consumer Price Index in February this year increased to 6.2%, the highest level seen in the UK for 30 years.

However, the far-reaching economic impact of the war in Ukraine and the re-emergence of Covid in China have brought about a rapid acceleration in inflation rates, now placing the topic firmly in the public eye.

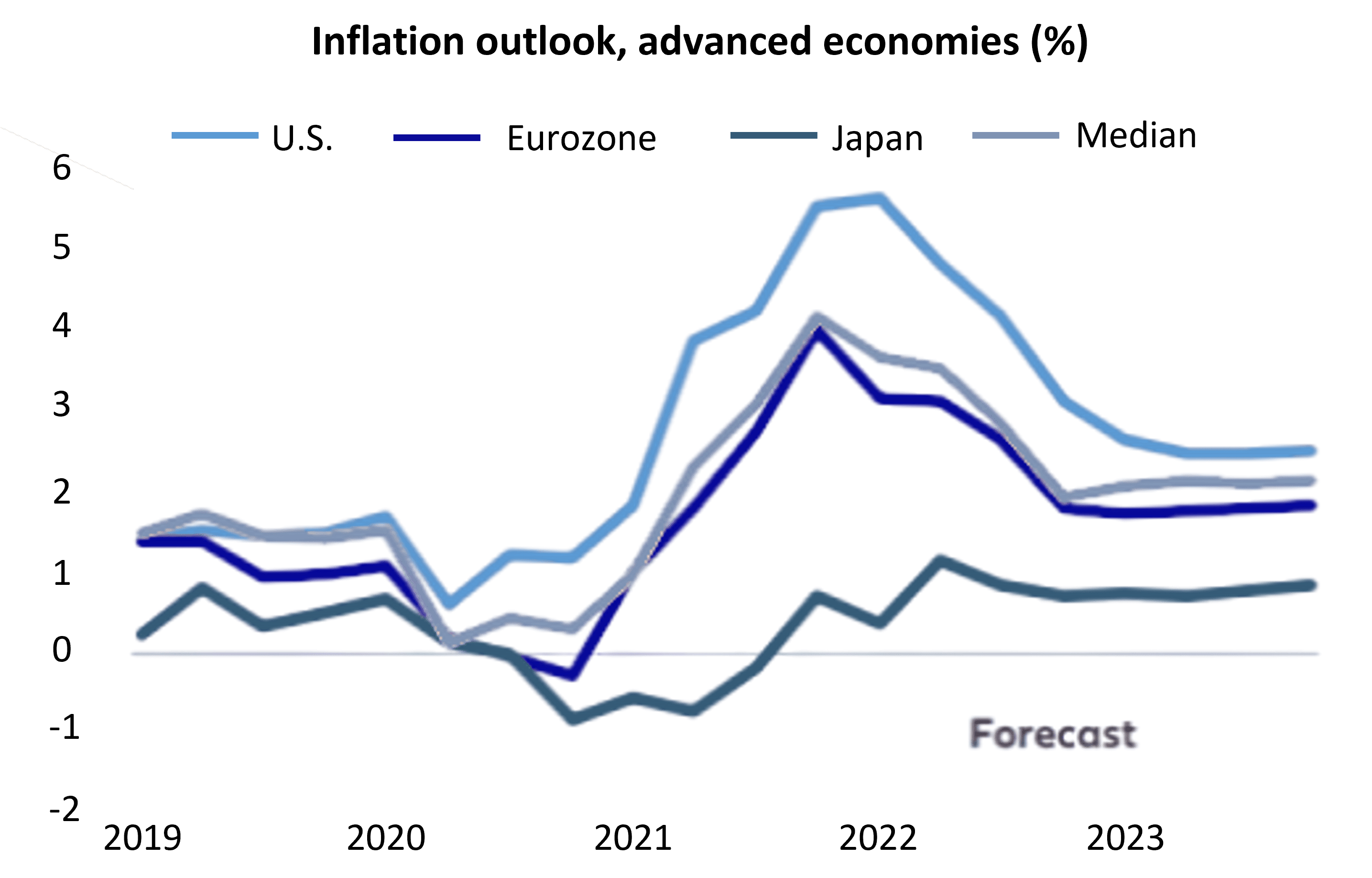

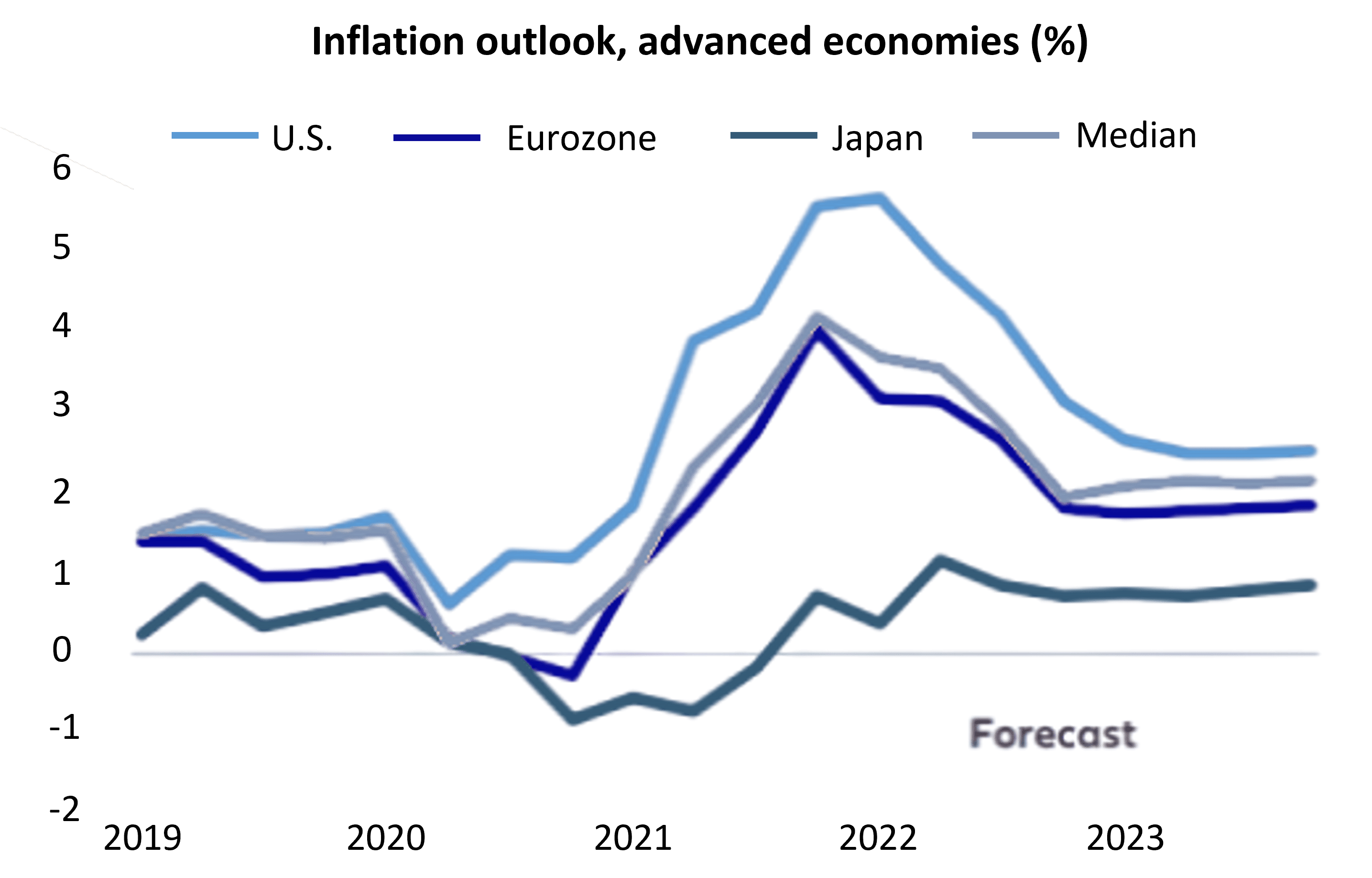

Figure 2: Rising inflation rates are very much a global occurrence with many regions2

Source: OECD, Economic Outlook Volume 2021, Issue 2, December 2021.

Figure 2 confirms rising inflation rates are very much a global occurrence with many regions recording some of the highest levels seen in recent times, leaving investors searching for tangible solutions to help minimise their exposure to the present inflationary environment.

But before we look at how private markets could help to hedge against inflation, it’s important to understand why certain businesses have traditionally suffered when inflation rates soar. In normal times, it’s common practice for businesses to increase revenue alongside costs. However, when inflation climbs, costs increase accordingly meaning businesses who struggle to increase revenue faster than that of their outgoing costs will be adversely impacted. Those with low fixed costs and a strong market standing will be able to weather the economic climate but companies unable to outmanoeuvre the rising costs, will be set for an incredibly challenging period.

Read more about how private markets look to be impacted and the potential roles these asset classes can play in helping investors navigate the inflationary climate over the course of 2022 and beyond.

Private equity: Selecting businesses with the right characteristics

As we demonstrated in our last article: “Private vs Public Markets: Why investors are flocking to private equity in search of consistently higher return”, private equity has historically consistently demonstrated its ability to outperform its public equivalents in uncertain economic times, and inflationary periods are no different.

With that in mind, asset allocation in private equity becomes even more crucial as there are businesses that will naturally struggle in a high inflation environment. Fund managers will have the ability to pick and choose the right investments for the current economic climate – mainly choosing to invest in businesses with a strong market position which offers mission-critical products enabling them to pass on future price rises to their consumers without sacrificing order volumes.

Additionally, when investing in private equity you have a fund manager at the wheel of the investment, experienced in creating value throughout different and, at times, challenging economic cycles. They will work with management teams to enhance value wherever possible which could involve addressing any potential supply chain issues, undertaking cost-saving exercises, or perhaps adopting a more proactive ‘buy and build’ strategy by acquiring competitors and subsequently increasing their market share.

Read more about how private equity continues to demonstrate its flexibility by selecting suitable investments to thrive during periods of high inflation.

Private real estate & infrastructure: Advantageous characteristics during inflationary periods

Real estate has proven to offer long-term protection from periods of rising inflation, according to research looking at the asset class over a 40-year period.3 One of the main factors believed to be behind this trend is the ability of real estate operators to increase property rent alongside rising costs.

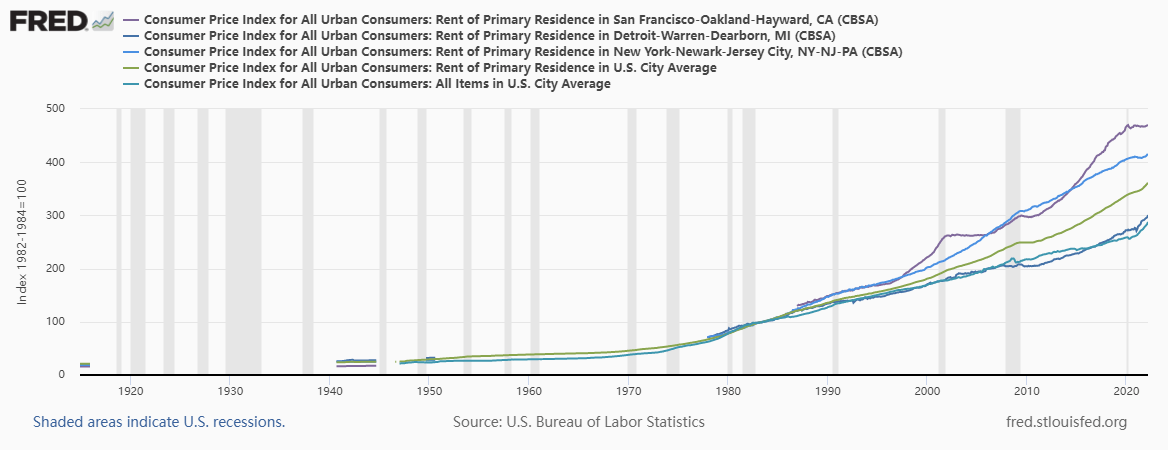

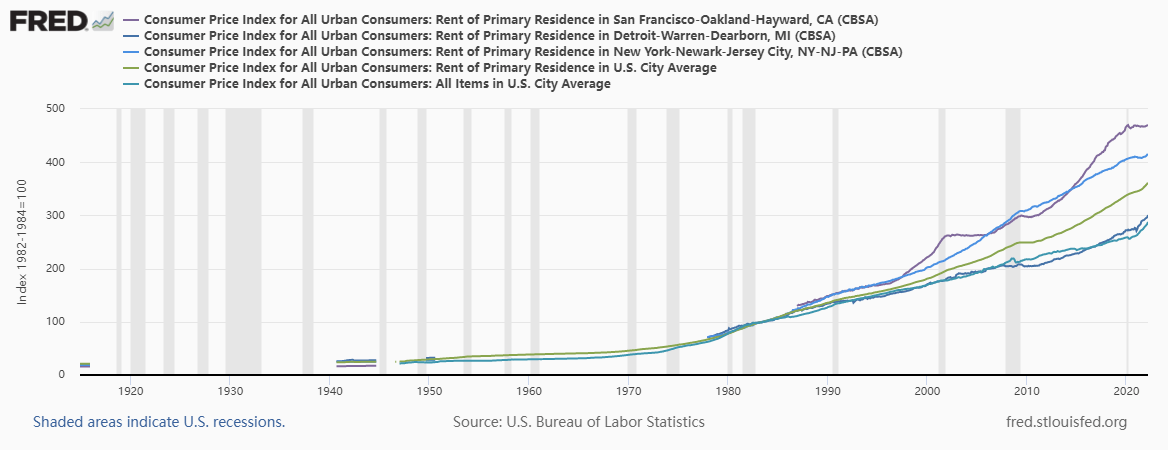

Figure 3: Increases in rent in US city residences have consistently surpassed inflation growth since the 1980s4

Source: U.S. Bureau of Labor Statistics

Indeed, we can see from Figure 3 that increases in rent in US city residences have consistently surpassed inflation growth since the 1980s.

While investors will need to make the choice between private and public real estate investments, there is research showing how private markets can be a safe bet during unpredictable economic times, with real estate being no exception. In comparison to often volatile public markets, the increasingly more accessible private real estate investments have been reported to generate 2.5 times5 better risk-adjusted returns than their public equivalents.

Similarly, infrastructure has a number of attractive characteristics when looking to hedge against high levels of inflation, with the asset class traditionally performing well in an inflationary environment. Regulated infrastructure assets – such as water, power grids, airports or toll roads – typically feature an explicit inflation-link, allowing tariffs to increase in line with inflation. Furthermore, infrastructure projects are generally long dated and require significant capital expenditures upfront, however need comparatively little in terms of annual maintenance or operating expenses. Maintenance expenses are also often contractually fixed upfront as well, limiting cost pressures in an inflationary environment.

Private credit: Guarding against future hikes in interest rates

Another investment avenue well worth pursuing when inflation climbs is the ever-growing asset class of private credit. Due to a combination in record levels of company valuations propped up by low interest rates and an increasingly inflationary environment, there is understandable concern that interest levels will begin to rise significantly, causing a swell of damaging corrections in company valuations.

Fortunately, one of the main attractions of investing in private credit, especially during inflationary times, is that the loans used in this asset class are generally floating rate, offering a greater degree of protection from the inevitable rises in interest rates during prolonged periods of high inflation.

Furthermore, with reported yields 270-300 basis6 points above equivalents available in alternative loan markets, coupled with the asset class benefiting from the fund manager’s experience to select the best deals to thrive in the current climate, it’s hard to see why private credit would not play a major role in a diversified portfolio aiming to minimise exposure against rising inflation.

While the prospect of a lengthy period of high inflation will understandably have many investors worried about the negative consequences to their current portfolios, as highlighted in this article, private markets can offer a safe and proven route to not only hedge against inflation but, at the same time, generate attractive and sustainable returns for their diversified portfolios.

Risk warning: Investment is restricted to professional, high net worth and sophisticated investors who can demonstrate that they have sufficient knowledge and experience to understand the risks of investing. Risks include the potential loss of capital and limited liquidity. Investments are long term and it may not be possible to sell your investment prior to maturity. Past returns are not a reliable indicator of future performance.

Disclaimer: All Rights Reserved. No part of this publication may be reproduced, stored in a retrieval system or transmitted in any form by any means, electronic, mechanical, photocopying, recording or otherwise, without the prior permission of the publisher, Bite Investments. The facts of this white paper are believed to be correct at the time of publication but cannot be guaranteed. Please note that the findings, conclusions and recommendations that Bite Investments delivers are based on information gathered in good faith from both primary and secondary sources, whose accuracy we are not always in a position to guarantee. As such, Bite Investments, can accept no liability whatsoever for actions taken based on any information that may subsequently prove to be incorrect.

This document has been prepared purely for information purposes, and nothing in this report should be construed as an offer, or the solicitation of an offer, to buy or sell any security, product, service or investment.

Sources:

[1] Office for National Statistics, Inflation and price indices, (accessed April 2022)

[2] Allianz, Real estate investing in an uncertain environment, (March 2022) (accessed April 2022)

[3] Allianz, Real estate investing in an uncertain environment, (March 2022) (accessed April 2022)

[4] BVG Partners, Is Private Real Estate a Hedge Against Inflation? (June 11, 2021) (accessed April 2022)

[5] Real Asset Adviser, Private vs. public real estate: Not all real estate is created equal, and new structures have made private real estate more accessible to individual investors, (October 1, 2018) (accessed Apr 2022)

[6] Adams Street, Private Credit Update: Resilience and Opportunity When Facing Inflation, (September 9,2021) (assessed April 2022)

Disclaimer: All Rights Reserved. No part of this publication may be reproduced, stored in a retrieval system or transmitted in any form by any means, electronic, mechanical, photocopying, recording or otherwise, without the prior permission of the publisher, Bite Asset Management. The facts of this article are believed to be correct at the time of publication but cannot be guaranteed. Please note that the findings, conclusions and recommendations that Bite Asset Management delivers are based on information gathered in good faith from both primary and secondary sources, whose accuracy we are not always in a position to guarantee. As such, Bite Asset Management, can accept no liability whatsoever for actions taken based on any information that may subsequently prove to be incorrect.

This document has been prepared purely for information purposes, and nothing in this report should be construed as an offer, or the solicitation of an offer, to buy or sell any security, product, service or investment.