Alternative investments:

Alternative investments refer to financial assets that fall outside the traditional categories of stocks, bonds, and cash. These assets include a wide range of options such as real estate, hedge funds, private equity, commodities, and collectibles. Investors turn to alternative investments to diversify their portfolios and potentially achieve higher returns, often with higher risk levels compared to traditional investments.

Anchor investor:

An anchor investor, typically an institutional entity or high-net-worth individual, commits a substantial investment to a fund or company, serving as a key participant that enhances confidence among other potential investors and stakeholders.

Blind pool:

In a blind pool, investors contribute capital without prior knowledge of the specific assets the fund will acquire. The fund managers have the discretion to make investment decisions, providing flexibility but requiring trust from investors.

Bottom quartile:

In the context of private equity fund performance, the bottom quartile refers to the lowest 25% of funds ranked by their investment returns within a specific peer group or dataset. Funds within this quartile have typically demonstrated lower performance compared to their peers over a particular period. Investors often use this metric to assess relative fund performance, and investing in funds consistently placed in the bottom quartile may imply higher risk and potentially lower returns compared to those in higher quartiles. As such, investors may reconsider allocating capital to consistently underperforming funds and focus on funds with better performance metrics.

Buyout:

Buyout investment strategies involve the acquisition of a significant ownership stake or full control of a company, typically using a combination of equity and debt financing. Private equity firms or investors lead buyout transactions with the objective of restructuring, improving the target company’s operations, and ultimately increasing its value over a specified investment horizon. These strategies can take various forms, including leveraged buyouts (LBOs), management buyouts (MBOs), and corporate takeovers, and they are often associated with active management and operational changes to drive growth and profitability.

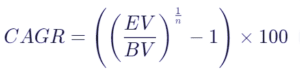

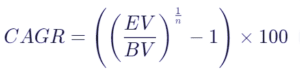

CAGR (Compound Annual Growth Rate):

CAGR stands for Compound Annual Growth Rate. It is a measure used to determine the annual growth rate of an investment, asset, or business over multiple years, taking into account the effects of compounding. CAGR provides a smoothed annual growth rate, assuming that the investment or business’s value or performance changes at a constant rate over the specified period. It is a useful metric for assessing and comparing the performance of investments or businesses, especially when the growth rate varies over time. CAGR is calculated using the formula:

Where:

EV is the ending value of the investment or business.

BV is the beginning value of the investment or business.

n is the number of years in the investment period.

Carry / carried interest / incentive fee / performance fee:

Carried interest, often referred to as “carry,” is a share of the profits earned by the General Partner (GP) in a private equity or venture capital fund. It is a performance-based incentive typically structured as a percentage of the fund’s investment gains. General Partners receive carried interest as part of their compensation for successfully managing the fund and generating positive returns for Limited Partners (LPs).

Carried interest is usually paid to the GP once certain benchmarks, known as “hurdles,” are met, and it is a way to align the interests of the fund managers with those of the investors. In the United States, carried interest is often subject to favorable tax treatment, which has been the subject of debate and regulatory scrutiny in recent years. It is an essential element of the economics of private equity and venture capital investment funds.

Cap rate:

The capitalization rate (cap rate) is a financial metric used in real estate to evaluate the potential return on an investment property. It is calculated by dividing the property’s net operating income (NOI) by its current market value or acquisition cost and is typically expressed as a percentage.

Capital call:

A capital call is a request made by an investment fund, such as a private equity or real estate fund, to its investors (Limited Partners) for the release or drawdown of committed capital. This request is typically made when the fund needs access to the capital that investors have committed but have not yet contributed upfront. Investors are required to fulfill these capital calls by providing the specified amount of capital according to the terms outlined in the fund’s partnership agreement.

Cash drag:

Cash drag, in the context of investment funds, refers to the situation where a portion of the fund’s assets remains uninvested or in cash rather than being deployed into income-generating or appreciating investments. This can reduce the overall returns of the fund, as the cash is often held in low-yield, low-return instruments while waiting for suitable investment opportunities.

Closed fund:

Closed funds typically refer to investment funds that are no longer open for subscription or new investment. In other words, these funds have a fixed number of shares or units, and once they are all sold or allocated, the fund is considered closed to new investors. Existing investors can continue to trade shares among themselves, but the fund cannot accept new capital.

Closed-ended fund:

Closed-ended funds are investment funds with a fixed number of shares or units outstanding, and they do not continuously issue new shares to investors. They are typically traded on secondary markets, like stock exchanges, where investors can buy and sell shares from one another. Closed-ended funds often have a finite maturity period, after which the fund is liquidated, and investors receive their share of the fund’s assets.

“Closed funds” and “closed-ended funds” are terms often used interchangeably, but they have slight differences in meaning.

- Closed Funds: Closed funds typically refer to investment funds that are no longer open for subscription or new investment. In other words, these funds have a fixed number of shares or units, and once they are all sold or allocated, the fund is considered closed to new investors. Existing investors can continue to trade shares among themselves, but the fund cannot accept new capital.

- Closed-Ended Funds: Closed-ended funds are investment funds with a fixed number of shares or units outstanding, and they do not continuously issue new shares to investors. They are typically traded on secondary markets, like stock exchanges, where investors can buy and sell shares from one another. Closed-ended funds often have a finite maturity period, after which the fund is liquidated, and investors receive their share of the fund’s assets.

In summary, both terms refer to funds with a fixed number of shares, but “closed-ended funds” specifically emphasize the trading of shares on secondary markets and often have a predetermined termination date. “Closed funds” merely imply that the fund is not open to new investors.

Co-investment:

Co-investment strategies involve multiple investors or entities jointly investing in a particular deal, project, or asset alongside the lead investor or sponsor. This approach allows investors to pool their resources, spread risk, and access investment opportunities that might be otherwise unavailable to them individually. It also allows LPs to effectively lower the cost of investing in a particular fund, as co-investments are typically offered on a no-fee, no carry basis. Co-investments are often seen in private equity, real estate, and other alternative asset classes and can offer cost savings and the potential for higher returns.

Committed capital / Commitment:

Committed capital refers to the total amount of capital that investors have pledged or promised to contribute to an investment fund, typically over a specified investment period. This commitment represents the capital that the investors are legally obligated to provide when called upon by the fund’s General Partner, often in response to capital calls, to support the fund’s investment activities.

Core infrastructure:

Core infrastructure refers to the essential physical and organizational structures, facilities, and systems that are vital to the functioning of a society or economy. These typically include critical assets like transportation networks (roads, bridges, airports), energy facilities (power plants, electrical grids), water and wastewater systems, and communication networks. Core infrastructure investments are often characterized by stable cash flows, long-term operational stability, and a critical role in supporting economic activities and public welfare.

Core-plus infrastructure:

Core-plus infrastructure refers to a subset of infrastructure investments that fall between core and value-add strategies in terms of risk and return. These investments involve assets that are already established and typically considered part of core infrastructure, such as toll roads, airports, or utilities. However, core-plus strategies involve some level of enhancement or improvement, such as expanding capacity, upgrading technology, or improving operational efficiency. This approach aims to generate higher returns than core investments compared to value-add or opportunistic infrastructure investments.

Deal flow:

Deal flow refers to the rate or volume at which investment opportunities, such as potential acquisitions or investments in assets or companies, are presented to and considered by investors or dealmakers. It encompasses the process of sourcing, evaluating, and ultimately executing investment transactions. A strong deal flow is typically indicative of a healthy pipeline of opportunities and can be essential for investors and organizations seeking to grow their portfolios or businesses.

Direct lending:

Direct lending is a form of financing in which loans are extended directly from lenders, such as institutional investors or non-bank financial institutions, to borrowers, typically businesses, without the involvement of traditional banks. It represents a direct capital flow from the lender to the borrower, often in the form of debt instruments, and can offer borrowers an alternative source of funding with potentially more flexible terms and quicker access to capital.

Distressed debt:

Distressed debt refers to debt securities or loans that are issued by a company or entity facing financial distress or an increased risk of default. These debt instruments are often traded in secondary markets at significantly discounted prices because investors perceive a higher level of risk associated with the issuer’s financial stability. Distressed debt can include bonds, loans, or other debt obligations and is typically bought by investors who believe they can profit from the potential recovery of value when the issuer’s financial situation improves or through the restructuring of the debt.

Distressed-for-control (loan-to-own):

Distressed-for-control, often referred to as “loan-to-own,” is an investment strategy in which an investor acquires a significant portion of a distressed company’s debt with the intention of gaining control over the company through a bankruptcy or debt restructuring process. The goal of this strategy is to use the ownership of the debt to influence the company’s operations and management, eventually taking ownership and potentially turning the distressed company around for a profit. This approach involves the purchase of distressed debt, such as bonds or loans, at a discount and is often employed by investors with the expertise and resources to navigate complex bankruptcy proceedings and corporate restructurings.

DPI (Distributions to Paid In Capital):

DPI, which stands for Distributions to Paid In Capital, is a financial metric used in the context of private equity and venture capital investments. It represents the ratio of the total distributions or returns received by the limited partners (investors) in a fund to the amount of capital they initially contributed or “paid in” to the fund. DPI is an important measure for assessing the performance of a fund and is often used to track the extent to which investors have recouped their original investments.

Dry powder:

Dry powder, in the context of private equity and venture capital, refers to the amount of uninvested or unallocated capital that a fund has available for investment. It represents the cash reserves that the fund has raised from investors but has not yet deployed into investments. Dry powder can be used to seize new investment opportunities, support existing portfolio companies, or take advantage of favorable market conditions. It is an important metric for assessing a fund’s capacity to make future investments and may influence its investment strategy and timing.

Due diligence:

Due diligence is a comprehensive and systematic investigation or research process that individuals, organizations, or investors undertake before entering a business transaction, such as an acquisition, investment, or partnership. It involves the examination of relevant information, financial records, legal documents, and other critical factors to assess the risks, opportunities, and the overall feasibility of the transaction.

ELTIF (European Long-Term Investment Funds):

ELTIFs, regulated in the European Union, are investment funds designed to channel capital into long-term projects, including infrastructure, real estate, and small-to-medium-sized enterprises (SMEs), promoting economic development.

Evergreen fund:

An evergreen fund is an investment fund structure that does not have a fixed or predetermined end date. Instead, it allows the fund to operate indefinitely, continually accepting new investments and making new investments or divestitures as opportunities arise, without a planned liquidation or termination date. Evergreen funds are often used in the context of venture capital, private equity, and certain alternative asset classes to provide flexibility in managing investments and capital.

Exit strategy:

An exit strategy is a predetermined plan or approach used by investors, business owners, or fund managers to liquidate or divest their investment in a company or asset, typically with the goal of realizing a profit or achieving specific financial objectives. It outlines how and when the investment will be sold, transferred, or otherwise monetized, and can include strategies such as selling to a strategic buyer, conducting an initial public offering (IPO), or merging with another company.

Expense cap:

An expense cap is a predetermined limit or ceiling on the total operating expenses that can be incurred by an investment fund. It represents the maximum percentage of a fund’s average net assets that can be used to cover various operational costs, including management fees, administrative expenses, and other fees charged to investors.

Financial Investor:

A financial investor, often referred to as a “financial buyer,” is an individual, institution, or entity that primarily invests capital or funds in various financial instruments, assets, or businesses with the expectation of earning a financial return on their investments. Financial investors typically aim to generate profits through capital appreciation, dividends, interest income, or other financial gains and may include entities such as mutual funds, hedge funds, private equity firms, or individual investors. They are distinguished from strategic investors, who invest in assets or businesses as part of their core business operations.

Follow-on investment:

Follow-on investments refer to additional investments made by an investor or fund into an existing portfolio company or asset in which they have previously invested. These subsequent investments are typically made to support the ongoing growth, development, or capital needs of the company or asset, and they can take various forms, including equity injections, debt financing, or additional rounds of funding.

Fund of funds:

A fund of funds (FoF) is an investment strategy where one investment fund invests in other underlying investment funds, rather than directly in individual assets or securities. Fund of funds provide investors with diversification across multiple funds and investment strategies, allowing them to access a broad range of asset classes and managers within a single investment vehicle.

Fund term:

The fund term, in the context of investment funds, represents the specified duration or period for which the fund is expected to be in operation before it reaches its maturity or dissolution. This timeframe is determined in the fund’s governing documents and outlines the planned life of the fund during which investments will be made, managed, and eventually liquidated.

Growth capital:

Growth capital is a form of private equity investment directed at established companies seeking capital for expansion, innovation, or restructuring, with the aim of accelerating their growth trajectory.

Growth private equity:

Growth private equity is an investment strategy that provides capital to established companies, whether profitable or not, with demonstrated growth potential, aiming to expand their operations without the significant use of leverage. This strategy differs from venture capital, which supports earlier stage startups, as well as buyouts, which typically invest in more cash-generating businesses and often involve more substantial leverage, making growth private equity a relatively less leveraged and more growth-focused approach.

GP (General Partner):

In the context of private equity, a General Partner (GP) is a key individual or entity responsible for managing and operating a private equity fund. The GP plays a central role in the fund’s activities, including sourcing and selecting investment opportunities, making investment decisions, and overseeing the portfolio companies in which the fund has invested. GPs typically raise capital from limited partners (investors in the fund), and they are often compensated through management fees and a share of the profits, known as carried interest, which provides them with a financial incentive to generate strong returns for the fund’s investors.

GP-led secondaries:

GP-led secondaries refer to a type of secondary transaction in the private equity space where the General Partner (GP) of a fund initiates the sale or restructuring of specific portfolio assets within the fund’s existing holdings. This process is orchestrated by the fund’s management team, often offering limited partners (LPs) choices regarding their existing investments, such as allowing them to sell their positions or roll their interests into a new vehicle.

Gross IRR (Internal Rate of Return):

Gross IRR (Internal Rate of Return) represents the annualised rate at which an investment grows or generates returns before deducting fees, expenses, or taxes. It reflects the investment’s overall performance and is calculated based on the cash flows, including both capital contributions and distributions, without considering the impact of costs or fees associated with the investment.

Gross MOIC (Multiple on Invested Capital):

Gross MOIC (Multiple on Invested Capital) measures the total value received from an investment relative to the initial capital invested, before accounting for fees, expenses, or taxes. It quantifies the multiple or ratio of the total investment’s value, including distributions and residual value, compared to the original amount of capital invested, providing insight into the investment’s overall performance.

Harvesting period:

The harvesting period refers to a phase in the lifecycle of an investment fund, particularly in private equity or venture capital, during which the fund manager actively focuses on realizing or “harvesting” the returns from investments made earlier in the fund’s life. This period typically occurs towards the later stages of the fund’s life cycle when the fund manager aims to sell or exit investments to realize profits and distribute returns to the fund’s investors before the fund’s scheduled termination or winding down.

Holding period:

The holding period refers to the duration of time an investor holds an investment before selling, liquidating, or otherwise exiting the position. It measures the length of time from the initial acquisition of the investment until its disposal or exit. In the context of private equity or venture capital, the holding period often spans several years, reflecting the longer-term nature of these investments before realizing returns through an exit strategy such as a sale or IPO.

Infrastructure investments:

Infrastructure investments involve allocating capital to essential physical assets, such as transportation, energy, utilities, and social infrastructure projects, contributing to the development and maintenance of critical societal systems.

Illiquidity premium:

The illiquidity premium refers to the additional return or compensation demanded by investors for investing in assets or securities that lack liquidity or the ability to be easily sold or converted into cash without significantly affecting their market price. This premium reflects the extra return investors expect to receive for bearing the risks associated with less liquid investments, such as certain private equity, real estate, or restricted securities, compared to more liquid investments like publicly traded stocks or highly liquid bonds.

ITD (Inception-to-Date):

ITD stands for “Inception to Date.” It is a timeframe used in financial reporting or analysis that refers to the period from the inception or the beginning of an investment, project, or a fund’s existence up to the present date. ITD provides a comprehensive view of performance or activities from the initial starting point until the current moment, allowing for a holistic assessment of the cumulative progress or results over that entire period.

Institutional investor:

An institutional investor refers to an organization or entity that invests large pools of money on behalf of others. These investors include entities such as pension funds, endowments, insurance companies, mutual funds, hedge funds, and banks, among others. They typically manage funds from various individuals or groups, seeking to achieve specific investment objectives, often with a long-term perspective, and generally have substantial financial resources and expertise in managing investments.

Interval fund:

An interval fund is a type of investment fund that combines features of both closed-ended and open-ended funds. Interval funds periodically offer to repurchase shares from investors at specified intervals (e.g., quarterly or semi-annually) rather than providing daily liquidity like traditional open-ended funds. They may invest in various asset classes such as stocks, bonds, or alternative investments and aim to provide investors with liquidity opportunities while maintaining a diversified portfolio.

Invested capital:

Invested capital refers to the total amount of capital or funds that have been deployed or used in an investment. It includes the initial principal or equity invested, along with any additional capital contributions or reinvested earnings. Invested capital represents the total amount committed to an investment opportunity, which may include both the investor’s own contributions and any borrowed funds or leverage used in the investment.

Investment period:

An investment period refers to the specific duration or timeframe during which an investment fund, typically in private equity, venture capital, or similar alternative investments, actively makes new investments in various assets or companies. This period, as defined in the fund’s agreement, marks the time when the fund manager is authorized to deploy committed capital into potential opportunities. Usually, the investment period is followed by a subsequent period (see harvesting period) during which the fund manages, and monitors, these investments before seeking exits or realizing returns.

IRR (Internal Rate of Return):

The Internal Rate of Return (IRR) is a financial metric used to estimate the annualised rate at which an investment grows or generates returns based on its cash flows, considering both the initial outlay and subsequent inflows and outflows. IRR assumes reinvestment of cash flows at the same rate, which may not align with actual market conditions, leading to potential inaccuracies, especially when comparing projects with different cash flow patterns. However, despite these limitations, IRR is widely utilized as a basis for performance measurement, aiding investors in evaluating the potential profitability and comparing the attractiveness of diverse investment opportunities.

IPO (Initial Public Offering):

An IPO, or Initial Public Offering, is the process by which a privately held company offers its shares to the public for the first time, allowing investors to purchase ownership stakes in the company. Through an IPO, the company raises capital by selling its shares to public investors, and after the offering, these shares become traded on a stock exchange, enabling investors to buy and sell the company’s stock on the open market.

J-curve:

The J-curve is a graphical representation that illustrates the typical pattern of returns or cash flows experienced by an investment fund, particularly in private equity, venture capital, or real estate. Initially, after making investments, the fund experiences a period of negative or low returns in the early years, depicted as the downward part of the ‘J’, as the investments require time to mature, grow, and generate returns. Subsequently, as successful investments begin to realize their potential and generate profits, the returns gradually increase, forming the upward part of the ‘J’, potentially surpassing the initial investment value over time.

Key person risk:

Key person risk refers to the potential negative impact on an organization, business, or investment due to the loss, incapacity, or departure of a key individual who plays a critical and irreplaceable role in the success, operation, or management of the entity. This risk arises when the absence of such key persons, often key executives, leaders, or key investment professionals, could significantly disrupt operations, decision-making, or the ability to achieve objectives, potentially resulting in financial or operational challenges for the organization or investment.

Key person clause:

The key person clause, found in an investment fund’s agreement, identifies critical individuals pivotal to the fund’s management and success, often including fund managers or key investment professionals. It specifies the circumstances, such as departure, death, or disability, under which the absence of these key persons might trigger consequences for the fund’s operations or allow limited partners (LPs) to take certain actions, like halting new investments or potentially terminating the fund. This clause aims to protect investor interests by acknowledging the importance of specific individuals and providing a mechanism to address risks associated with their absence.

LPA (Limited Partnership Agreement):

LPA stands for Limited Partnership Agreement. It is a legally binding document that outlines the terms, conditions, and guidelines governing the operation, management, and investment activities of a limited partnership, particularly in the context of private equity, venture capital, or real estate funds. The LPA specifies the rights, obligations, responsibilities, and distribution mechanisms for both the General Partner (GP) and the Limited Partners (LPs), including aspects related to capital commitments, profit-sharing, governance, reporting, and fund dissolution.

Liquidity:

In the context of private equity, liquidity refers to the ease and speed with which an investment or asset can be converted into cash or sold in the market without significantly affecting its price. Private equity investments typically have lower liquidity compared to publicly traded assets, as they are often held for longer periods before being sold or exited. The liquidity of a private equity investment can vary depending on market conditions, the nature of the investment, and the fund’s specific terms and exit strategies.

Lock-up period:

A lock-up period refers to a specific duration, often stated in investment agreements or contracts, during which investors are prohibited or restricted from redeeming or selling their investment shares or interests. It is a predetermined period where investors are legally bound to maintain their investment without the ability to liquidate or withdraw their funds from the investment vehicle. Lock-up periods are commonly observed in various investment vehicles such as hedge funds, private equity funds, and certain types of structured investments.

Loss ratio:

In the context of a private equity fund investment, the loss ratio typically refers to the ratio of the total losses incurred on the investments within the fund to the total invested capital. It measures the proportion of the fund’s investments that have experienced losses compared to the overall invested capital.

In private credit, the loss ratio represents the ratio of the total credit losses experienced within a portfolio of loans or credit investments to the total value of the portfolio. It indicates the percentage of loans that have defaulted or experienced losses compared to the overall value of the credit portfolio.

LP (Limited Partner):

In the context of private equity, a Limited Partner (LP) refers to an individual or institutional investor who provides capital to a private equity fund. LPs are passive investors and do not have a direct role in the day-to-day management of the fund or its portfolio companies. They invest in the fund with the expectation of receiving returns on their investment, and they typically entrust the fund’s General Partner (GP) with the responsibility of making investment decisions and managing the fund’s assets. LPs may include pension funds, endowments, family offices, and high-net-worth individuals, and they benefit from any profits generated by the fund’s investments, typically subject to the terms outlined in the fund’s limited partnership agreement.

LPAC (Limited Partner Advisory Committee):

An LPAC stands for Limited Partner Advisory Committee, which is a committee formed within an investment fund, typically in private equity or similar alternative investments. The LPAC represents the interests of limited partners (LPs) in the fund’s governance and decision-making processes. It generally comprises a group of selected limited partners who provide guidance, oversight, and feedback on matters such as fund operations, investment strategies, fund manager performance, conflicts of interest, and significant transactions. The LPAC plays an advisory role, offering insights and recommendations to the fund’s general partner (GP) or management team to align with the interests of the limited partners.

LTAF (Long-Term Asset Funds):

The LTAF is a type of fund structure introduced by the UK Financial Conduct Authority (FCA). It is designed to facilitate long-term investment in illiquid assets such as private equity, infrastructure, and real estate. The LTAF structure aims to provide investors with access to long-term investment opportunities while maintaining a level of liquidity through features like notice periods for redemptions.

LTM (Last Twelve Months):

LTM, short for Last Twelve Months, represents a company’s financial metrics over the immediate past twelve months. It serves as a crucial tool in performance measurement by offering a consolidated view of a company’s recent financial performance, aiding analysts, and investors in assessing trends, identifying growth patterns, and evaluating the company’s overall health over that specific timeframe.

Management buyout & buy-in:

A management buyout (MBO) occurs when the existing management team acquires significant ownership in a company, facilitating succession or strategic shifts. Conversely, a management buy-In (MBI) involves external managers acquiring ownership and control of a business.

Management fee:

A management fee is a recurring charge or compensation paid by investors to the fund manager or investment manager for overseeing and managing investment assets on their behalf. It is a fee for the services provided by the management team in administering and executing the investment strategy of a fund. In the context of investment funds such as mutual funds, hedge funds, or private equity funds, the management fee is typically calculated as a percentage of investor’s total commitment. This fee is charged annually and is usually a predetermined percentage, often ranging from 1% to 2% of the investor’s total commitment. The management fee compensates the fund manager for various operational, administrative, research, and management services rendered in managing the investment portfolio.

Management fee offset:

A management fee offset refers to a provision in an agreement, particularly in the context of private equity, where a fund manager’s management fee is reduced or offset by certain fees or expenses incurred by the fund or portfolio companies.

For instance, if the fund incurs certain transaction fees or expenses related to the acquisition or operation of portfolio companies, the management fee offset allows the fund manager to subtract those expenses from the management fee that would otherwise be payable by the investors. This provision effectively reduces the management fee by the amount of specified expenses, ensuring that the fund manager is not compensated twice for the same expenses — once through the management fee and again through separate fund expenses.

Mezzanine:

Mezzanine refers to a type of financing or investment that sits between senior debt and equity in the capital structure of a company. Mezzanine financing typically involves providing capital that combines features of both debt and equity instruments. It’s often used by companies to fund growth, acquisitions, or other expansion initiatives. Mezzanine financing can take various forms such as subordinated debt, preferred equity, or hybrid securities, offering lenders or investors a higher potential return compared to senior debt but with increased risk. It usually ranks below senior debt in terms of priority of repayment in the event of bankruptcy but ahead of common equity. The terms of mezzanine financing may include elements of both fixed interest payments and an equity stake in the company, providing flexibility to the borrower while meeting the risk-return preferences of investors.

NAV (Net Asset Value):

NAV stands for Net Asset Value. In finance and investments, NAV refers to the value of an entity’s assets minus its liabilities, usually expressed on a per-share or per-unit basis. It is a measure used primarily in evaluating the value of investment funds such as mutual funds, exchange-traded funds (ETFs), or real estate investment trusts (REITs). For investment funds, NAV is calculated by subtracting the fund’s liabilities (such as expenses and fees) from its total assets and then dividing the result by the number of outstanding shares or units (if an). NAV per share or unit is used to estimate the fair value of an investor’s holdings in the fund. It is typically calculated and published at the end of each valuation period (can be daily, weekly, monthly, or quarterly). NAV provides investors with insight into the underlying value of their investments in the fund.

NDA (Non-Disclosure Agreement):

NDA stands for Non-Disclosure Agreement. It is a legally binding contract or agreement between two or more parties that outlines the confidential information they share and restricts its disclosure to third parties. An NDA serves to protect sensitive or proprietary information from being disclosed, shared, or used without authorization. It defines the scope of the confidential information, the parties involved, the duration of confidentiality, and the circumstances under which the information can be shared or disclosed to others. NDAs are commonly used in business negotiations, partnerships, employment contracts, and when sharing proprietary information or trade secrets.

Net IRR (Internal Rate of Return):

Net IRR (Internal Rate of Return) in the context of private equity performance evaluation refers to the rate at which the net present value of cash flows from an investment equals zero, considering the impact of fees, expenses, and carried interest associated with the investment. Net IRR considers the actual return realized by investors after deducting fees, expenses, and carried interest from the investment’s cash flows. It reflects the hypothetical annualised rate of return on the net invested capital, providing a measure of the investment’s performance adjusted for costs and fees incurred during the investment period.

Net MOIC:

Net MOIC (Multiple on Invested Capital) measures the total value received by the end investor from an investment relative to the initial capital invested, after fees, expenses, carried interest and taxes. Net MOIC offers a measurement of the returns generated on the net invested capital, considering the fees, expenses, and carried interest that reduce the overall capital returned to investors. It provides a comprehensive view of the profitability of the investment by factoring in the costs and fees associated with managing the investment.

Non-traded REIT (Real Estate Investment Trust):

A non-traded Real Estate Investment Trust (REIT) refers to a type of REIT whose shares or units are not traded on a public stock exchange. Unlike publicly traded REITs that trade on stock exchanges like regular stocks, non-traded REITs are not listed on public markets and, therefore, do not have daily liquidity for investors to easily buy or sell shares. Non-traded REITs are typically sold through brokers or financial advisors in private offerings. They often focus on income-generating real estate investments such as commercial properties, residential properties, or other real estate assets. Investors in non-traded REITs usually commit capital for a longer-term horizon as these investments generally have limited liquidity and may have redemption restrictions compared to publicly traded REITs.

Open funds:

Open funds is a general term that can be used to refer to any type of investment fund that is currently open for new subscriptions or additional investments. These funds continuously accept new investments, allowing investors to buy shares or units at any time. Open funds have no restrictions on the number of investors who can participate.

Open-ended funds:

Open-ended funds are a specific category of investment funds that continuously issue and redeem shares or units at their net asset value (NAV). Investors can buy or sell shares directly from the fund at the NAV, which is determined based on the underlying assets’ value. Open-ended funds do not have a fixed number of shares, and their size can vary based on investor demand.

Let’s define “open funds” and “open-ended funds” and distinguish between the two:

Open Funds: “Open funds” is a general term that can be used to refer to any type of investment fund that is currently open for new subscriptions or additional investments. These funds continuously accept new investments, allowing investors to buy shares or units at any time. Open funds have no restrictions on the number of investors who can participate.

Open-Ended Funds: “Open-ended funds” are a specific category of investment funds that continuously issue and redeem shares or units at their net asset value (NAV). Investors can buy or sell shares directly from the fund at the NAV, which is determined based on the underlying assets’ value. Open-ended funds do not have a fixed number of shares, and their size can vary based on investor demand.

In summary, while “open funds” is a general term for funds open to new investments, “open-ended funds” specifically refer to investment funds that issue and redeem shares continuously at their NAV, and they do not have a fixed number of shares or units.

Pari passu:

“Pari passu” is a Latin term that translates to “on an equal footing” in English. In finance and investments, it refers to a situation where two or more classes of securities or creditors have equal rights, claims, or priority to receive payments, distributions, or benefits. When assets or obligations are considered pari passu, they are treated equally, without preference or priority given to one over the other. For instance, in bankruptcy proceedings, creditors with pari passu claims would have an equal entitlement to the distribution of assets.

PIK (Payment in Kind):

PIK stands for Payment in Kind, which refers to a type of payment made by issuing additional securities or debt instruments, rather than in cash. In PIK transactions, the issuer has the option to pay interest, dividends, or other obligations by providing additional securities or instruments instead of making cash payments. This mechanism allows the issuer to preserve cash in the short term and can be used in various financial arrangements, such as bonds, loans, or preferred stock, where the issuer can choose to make payments with additional securities rather than cash.

Portfolio company:

A portfolio company refers to a business or company that is held within the investment portfolio of a larger entity, such as a private equity firm, venture capital fund, or investment holding company. These companies are typically acquired or invested in by the larger entity, often as part of a diversified investment strategy. Portfolio companies can range from startups to established businesses and are usually subject to active management, strategic oversight, and value enhancement by the investor to maximize returns or achieve specific investment objectives.

Preferred return / Pref / Hurdle rate:

A preferred return, often referred to as a “hurdle rate,” is a contractual arrangement in investment agreements, especially in private equity, real estate, or certain alternative investments. It represents a predetermined rate of return that investors, typically limited partners (LPs), are entitled to receive before the general partner (GP) or investment manager can participate in the profit-sharing, commonly through receiving carried interest.

Under a preferred return arrangement, investors receive a specified percentage of the profits or cash flows generated by the investment before the GP is entitled to its share. This ensures that the investors receive a specified minimum return on their investment before the GP starts receiving a share of the profits, aligning the interests of the investors and the GP.

Primaries / primary investments:

Primary investments refer to the initial or direct investments made by investors, typically institutional investors like pension funds, endowments, or sovereign wealth funds, into various investment vehicles. These investments are made directly into assets, such as stocks, bonds, private equity funds, venture capital funds, real estate funds, or other investment vehicles, without relying on previously existing shares or ownership interests in those assets. Primary investments offer investors the opportunity to invest in newly issued securities or funds, often at the initial offering or creation stage, rather than acquiring existing or secondary market assets.

Private markets:

Private markets refer to the segment of the financial markets where investments are not publicly traded on stock exchanges. Instead, they involve privately negotiated transactions, often involving private equity, venture capital, real estate, and private debt. While alternative investments encompass a broader spectrum of non-traditional assets, private markets specifically pertain to the subset of those investments that are not publicly traded, involving ownership or participation in privately held companies or assets, typically with longer investment horizons and less liquidity compared to publicly traded assets.

Private equity:

Private equity is a form of alternative investment that involves investing in privately held companies or taking ownership stakes in them. Private equity firms typically raise funds from institutional and high-net-worth investors to acquire, invest in, or provide capital to companies with the aim of improving their performance and ultimately generating substantial returns. These investments often involve a more hands-on approach to management and a longer investment horizon than publicly traded stocks, and they can take various forms, such as leveraged buyouts or venture capital investments.

Private credit:

Private credit, also known as private debt, is a type of alternative investment that involves lending capital to privately held companies or borrowers, outside of traditional lending institutions like banks. Private credit can take various forms, including direct loans, mezzanine financing, and distressed debt. Investors in private credit typically seek to earn interest income and potentially benefit from the higher yields and less liquid nature of these investments compared to more traditional fixed-income securities.

PPM (Private Placement Memorandum):

A Private Placement Memorandum (PPM) is a legal document that provides detailed information to prospective investors about an investment opportunity, typically in a private placement offering. It contains essential information about the investment, including its terms, risks, financial projections, and the legal and regulatory framework, helping potential investors make informed decisions before committing capital to the investment.

Real assets:

Real assets are tangible, physical assets that have intrinsic value and can provide returns or income to investors. These assets can include real estate, infrastructure, natural resources, and commodities such as precious metals and agricultural products. Investors often turn to real assets as a way to diversify their portfolios, hedge against inflation, and potentially benefit from long-term appreciation and income generated by these tangible assets.

Realized proceeds:

Realized proceeds, in the context of investments, represent the actual cash or value received from the sale, liquidation, or divestment of an asset or investment. It reflects the amount of money generated from the realization of an investment, after accounting for expenses, taxes, and any other costs associated with the sale.

Redemption:

Redemption, in the context of investments, refers to the process by which an investor redeems or sells their investment, typically to the issuer or an investment fund, in exchange for cash or other assets. This can apply to various types of investments, including mutual funds, hedge funds, and some types of bonds, allowing investors to exit their investment and receive the corresponding value of their holdings.

Restructuring:

In the context of private investments, restructuring refers to a comprehensive process undertaken to make significant changes to the financial, operational, or organizational structure of a company or asset. It is often initiated in response to financial distress, underperformance, or a desire to improve efficiency and may involve actions such as debt restructuring, changes in management, operational overhauls, and the reallocation of assets to enhance the overall value and financial health of the investment.

Risk diversification:

Risk diversification is a strategic approach to investment that involves spreading capital across different assets or asset classes to mitigate risk. By avoiding overreliance on any single investment, diversification aims to enhance portfolio stability.

REIT (Real Estate Investment Trust):

REITs are companies that own, operate, or finance income-generating real estate. Providing a means for individual investors to access real estate assets, REITs distribute a significant portion of their income to shareholders through dividends.

RVPI (Residual Value to Paid-In Capital):

RVPI stands for Residual Value to Paid-In Capital, which is a financial metric used in the context of private equity investments. It represents the ratio of the remaining or unrealized value of the investments in a private equity fund (often the net asset value) to the total capital that investors have contributed or “paid in” to the fund. RVPI provides insight into the potential unrealized gains or losses that investors have yet to realize in their private equity investments.

Secondaries / secondary investments:

Secondary investments, in the context of private equity, involve the purchase of existing limited partner (LP) interests in private equity funds or the acquisition of individual private equity fund assets from other investors. This means that secondary investors are buying pre-existing investments made by other LPs in private equity funds. These transactions provide liquidity to existing investors, allowing them to exit their investments before the natural expiration of the fund. Secondary investments can involve a variety of private equity fund types and can offer opportunities for investors to gain exposure to a diverse portfolio of underlying assets.

Special situations:

Special situations, in the realm of finance and investing, refer to unique or unconventional investment opportunities that arise due to specific events, circumstances, or conditions affecting a company or an asset. These situations may include distressed assets, turnaround opportunities, corporate restructurings, bankruptcies, mergers and acquisitions, spin-offs, or other events that deviate from regular market conditions. Investors focusing on special situations seek to capitalize on these unique circumstances to potentially generate returns that are not solely dependent on traditional market movements.

SPV (Special Purpose Vehicle):

An SPV is a legal entity created for a specific purpose, often used in financial transactions or investment structures to isolate and protect assets, liabilities, and risks associated with a particular project or venture.

Sponsor:

In the context of finance and investments, a sponsor typically refers to an individual, entity, or organization that initiates, structures, or manages an investment vehicle or financial transaction. Sponsors often play a key role in bringing together investors, managing the investment strategy, and overseeing the implementation and execution of the investment. In private markets investing, it is used to effectively denote GPs. Sponsors are frequently the entities responsible for creating and managing investment funds or deals, providing expertise, and often contributing their own capital alongside investors.

Sponsorless deal:

A sponsorless deal, in the realm of debt financing or leveraged finance, refers to a transaction where a corporate entity seeks or obtains debt financing without the involvement or backing of a private equity firm or a financial sponsor. In such transactions, the borrowing company directly seeks debt capital from lenders or financial institutions to finance its operations, growth, acquisitions, or other corporate initiatives without the assistance or support of a private equity general partner (GP) or an external financial sponsor providing equity investment or guidance. This type of transaction allows the corporate entity to access debt capital independently without private equity ownership or involvement.

Strategic investor:

A strategic investor, often referred to as a “strategic buyer,” is an individual, institution, or entity that invests in assets, businesses, or other opportunities as part of their core business operations or with a specific strategic objective. Unlike financial investors, who primarily seek financial returns, strategic investors are driven by the desire to achieve operational synergies, gain competitive advantages, or expand their core business through the investments they make. They often invest in companies or assets that align with their existing business activities or that provide them with a strategic advantage in their industry or market.

Subscription document (sub doc):

A subscription document, often referred to as a subscription agreement, is a legal document used in the investment process, particularly in private placements or when investing in alternative investments such as private equity, hedge funds, or venture capital. This agreement outlines the terms, conditions, and details of an investor’s commitment to purchase securities or interests in an investment fund or offering. It includes crucial information such as the investor’s details, the amount of investment, payment terms, representations and warranties, subscription terms, disclosures, and any associated risks or legal obligations. The subscription document is signed by the investor and serves as a formal commitment and agreement between the investor and the fund.

Subscription fee:

A subscription fee is a one-time or recurring charge that an individual or entity pays to access a service, become a member, or receive ongoing benefits from a particular product, service, or organization. In finance or investment contexts, a subscription fee might refer to the initial fee an investor pays to join or participate in an investment fund, such as a private equity fund or a hedge fund. This fee is typically charged when an investor subscribes or commits capital to the fund and can cover administrative costs, management fees, or other expenses associated with managing the investment.

Syndication:

Syndication in finance refers to the process of collaborating with multiple lenders, investors, or financial institutions to provide funding for a single loan or investment opportunity. In syndication, a lead lender or arranger originates the loan or investment opportunity but involves other lenders or investors (syndicate members) to participate in funding the transaction. This method allows for the distribution of risk, increased capacity for larger deals, and broader access to capital by spreading the exposure among multiple parties. Syndication commonly occurs in various financial arrangements such as loans, project financings, mergers and acquisitions, and underwriting of securities.

Target fund:

A target fund is a specific investment fund that a manager aims to establish or invest in, defining the focus of capital deployment and investment decisions. The term refers to the fund or project towards which investment efforts are directed.

Top quartile:

In the context of performance evaluation, ‘top quartile’ refers to the highest-performing group of investments or funds compared to their peers within a specific investment category or industry. Funds or investments in the top quartile have achieved returns or performance metrics that place them among the top 25% of all similar funds or investments within a given period. This ranking is often used by investors, especially in private equity or venture capital, to identify funds with superior performance relative to their peers and may serve as a benchmark for evaluating investment managers or fund performance.

Trade sale:

A trade sale, also known as a strategic sale, refers to the process of selling a company or its assets to another operating company or strategic buyer within the same industry or related field. In a trade sale, the seller typically seeks to sell the business to another company or entity, often a competitor or a business seeking to expand its market presence, product offerings, or customer base through the acquisition. This type of sale contrasts with a financial sale where the buyer might be a private equity firm or an investment group. Trade sales can provide synergies, strategic advantages, and operational benefits to both the buyer and the seller in terms of market positioning, growth, or economies of scale.

Turnaround:

A turnaround strategy refers to a structured plan or set of actions implemented by a company’s management or investors to revitalize and reverse the declining performance or financial distress of a struggling business. This strategy involves comprehensive and often drastic changes in operations, management, finances, or structure to restore the company to profitability, competitiveness, and sustainability. Turnaround strategies may include initiatives such as cost-cutting measures, operational restructuring, leadership changes, product repositioning, market expansion, refinancing, or other strategic shifts aimed at improving the company’s performance and returning it to a path of growth and success.

TVPI (Total Value to Paid-In):

TVPI stands for Total Value to Paid-In, a performance metric used in evaluating the overall performance of an investment in private equity or venture capital. It represents the ratio of the total value of an investment, including both realized and unrealized gains, to the total amount of capital contributed by investors.

The TVPI considers both distributed and unrealized gains, providing a holistic view of the investment’s performance relative to the capital invested. It considers the current value of the investment portfolio, including profits generated and remaining unrealized value, and is used by investors to assess the efficiency of their capital deployment across various investment vehicles.

Unfunded commitment:

An unfunded commitment refers to the contractual obligation or commitment made by an investor, typically in the context of private equity or certain alternative investments, to provide additional capital to an investment fund at a future date. This commitment represents the total amount that the investor is obligated to contribute beyond the initial investment or capital already deployed. Until the capital is called by the fund manager, the commitment remains unfunded, indicating the investor’s obligation to make future contributions based on the fund’s capital needs or investment opportunities.

Unrealized value/investment:

The unrealized value of an investment represents the estimated or recorded value of an asset that has not yet been sold or realized. It is the current valuation of an investment, typically assessed at fair market value, which has not been converted into cash or sold at the prevailing market price. This valuation is based on the current market conditions or an estimate of the asset’s worth at a specific point in time, and it may fluctuate until the investment is eventually sold or exited, at which point the value becomes realized.

Valuation policy:

A valuation policy is a set of guidelines, principles, and procedures established by an organization or an investment fund that outlines the methodologies, criteria, and processes used to determine the value of assets, investments, or holdings. This policy typically defines the standards and practices employed for assessing the fair market value or pricing of various assets, including stocks, bonds, derivatives, private equity, real estate, and other investments. Valuation policies aim to ensure consistency, transparency, and accuracy in determining the value of assets, often in compliance with regulatory requirements and industry best practices.

Value creation plan/strategy:

In the context of a private equity, a value creation strategy refers to a deliberate and structured plan employed by the General Partner (GP) after acquiring a portfolio company with the aim of enhancing the company’s overall value within a defined period. This strategy involves implementing specific operational, financial, and strategic initiatives to drive growth, improve efficiency, optimize operations, expand market share, and increase profitability within the acquired company. The GP collaborates with management teams, leveraging their expertise, industry knowledge, and resources to execute value-creating measures, often with the goal of achieving a successful exit and maximizing returns for investors.

Venture capital:

Venture capital is a form of private equity investment that focuses on providing financing to early-stage, high-potential startups and small businesses with significant growth prospects. Venture capitalists, or VC firms, invest capital in exchange for an ownership stake in these companies, often taking a more active role in helping them grow and succeed. Venture capital plays a critical role in fostering innovation and entrepreneurship, typically with a higher tolerance for risk and a longer investment horizon than traditional investments.

Vintage year:

The vintage year, in the context of private equity and other alternative investments, refers to the specific year in which a fund makes its initial investments. It is the year in which the fund starts its investment activities, often by making its first investments in various assets or companies. The vintage year is used to track the performance and characteristics of a particular fund, as the performance of investments made during that year can impact the fund’s overall returns and risk profile.

Waterfall:

In the context of private equity, a waterfall refers to the distribution mechanism that outlines how profits or returns generated by the fund’s investments are allocated among different stakeholders, typically the Limited Partners (LPs) and the General Partner (GP). It specifies the order, timing, and priority of distributions, ensuring that the various parties receive their share of the profits based on the fund’s performance and the terms outlined in the fund’s partnership agreement. Waterfall provisions can be complex and often involve multiple tiers, such as the payment of management fees, return of capital, and the distribution of carried interest to the GP.

Workout:

In the context of recovering value from a distressed investment, typically debt, a workout refers to the process of negotiating and implementing a solution to address the financial difficulties or default of the debtor. This process may involve various strategies, including debt restructuring, negotiation of new terms, or the sale of distressed assets, all aimed at maximizing the recovery of value for creditors and stakeholders in a distressed investment or debt situation.

Write-down:

A write-down in the context of investment valuation involves reducing the estimated value of an asset, often due to factors such as a decline in market value, poor performance, or the recognition of losses. This adjustment results in a lower valuation compared to the asset’s previous value and can have implications for financial reporting or investment decisions.

Write-off:

A write-off refers to the complete reduction of an asset’s estimated value to zero, often due to factors such as a total loss, irrecoverable value, or a determination that the asset has no remaining economic value.

Write-up:

A write-up in investment valuation refers to the process of increasing the estimated value of an asset, such as a security or investment, due to various factors, such as favorable market conditions or improved financial performance. It typically results in a higher valuation compared to the asset’s previous value and can impact investment decisions or financial reporting.

YTD (Year-to-Date):

Year-to-date (YTD) is a financial and performance reporting term that represents the time from the beginning of the current calendar year to the present date. YTD figures provide a snapshot of an investment’s or business’s performance over the course of the year up to the specified date, offering insight into how it has performed within that timeframe. YTD returns or financial data are commonly used to assess investment performance, compare financial results, and track progress over the calendar year.

Disclaimer: All Rights Reserved. No part of this publication may be reproduced, stored in a retrieval system or transmitted in any form by any means, electronic, mechanical, photocopying, recording or otherwise, without the prior permission of the publisher, Bite Asset Management. The facts of this article are believed to be correct at the time of publication but cannot be guaranteed. Please note that the findings, conclusions and recommendations that Bite Asset Management delivers are based on information gathered in good faith from both primary and secondary sources, whose accuracy we are not always in a position to guarantee. As such, Bite Asset Management, can accept no liability whatsoever for actions taken based on any information that may subsequently prove to be incorrect.

This document has been prepared purely for information purposes, and nothing in this report should be construed as an offer, or the solicitation of an offer, to buy or sell any security, product, service or investment.